We want you to be prepared for whatever may come your way. Optional disability insurance is a valuable benefit that can provide you with financial security if you’re ever unable to work due to illness or a non-work-related injury.

Disability insurance can support you during difficult times, allowing you to focus on your recovery without the added stress of lost income. The following programs are managed by Sedgwick and Lincoln Financial Group.

Lincoln Financial Group Contact Information

Call 800.212.4898 with questions about your benefits and to file a claim.

Choose What’s Right for You!

According to the Council for Disability Awareness, approximately 5% of working Americans will experience a disability each year.

Based on your monthly expenses, consider how much of your base salary you’ll need.

Memorial Hermann offers two STD plans to ensure you have the protection you need.

The plan you’re eligible for depends on how long you’ve worked for Memorial Hermann.

Employee-paid plan: This plan is available to full-time and part-time employees who have worked for Memorial Hermann for less than 12 months. You may purchase employee-paid STD if you want coverage before you become eligible for the employer-paid plan. Pre-existing conditions may apply under this plan. This coverage is managed by Lincoln Financial Group and Sedgwick manages the application process.

The cost for the employee-paid plan is deducted from your biweekly paycheck. Your payments will be discontinued when you reach 12 months of employment.

Employer-paid plan: This plan is available to all full-time and part-time employees who have worked for Memorial Hermann for at least 12 months. If you’re eligible, you are automatically enrolled in STD coverage at no cost to you. This coverage is managed by Sedgwick.

Coverage Basics

|

Details |

Employee-Paid Plan |

Employer-Paid Plan |

|---|---|---|

|

Eligibility |

Full-time and part-time employees with less than 12 months of employment |

Full-time and part-time employees with 12 or more months of employment |

|

Benefit |

Up to approximately 60% of your base weekly income, to a maximum of $1,000 per week |

Up to 60% of your base salary |

|

Pre-existing condition exclusions |

Conditions in the last three to six months are excluded |

None |

|

Elimination period (how long you must be out before the benefit begins) |

Seven calendar days |

Seven calendar days |

|

Benefit duration |

180 calendar days (less the elimination period) |

180 calendar days (less the elimination period) |

|

Cost for coverage |

Your annual salary divided by 52 = your weekly salary. Weekly salary x 0.0219 Premiums end when you reach 12 months of employment and you are automatically enrolled in employer-paid STD |

$0 — Memorial Hermann provides this coverage at no cost to you |

An elimination period is the time you must wait at the beginning of an approved disability before benefits are paid. The STD plans have an elimination period of seven (7) calendar days. In the event you are unable to work your regular schedule due to an injury or illness and your claim is approved, your benefit will begin on the eighth calendar day of your illness or injury.

During the elimination period, you are required to use your leave balances. Leave balances include paid time off (PTO), personal holidays (PHO), spiritual holiday (SHO), PTO Buy, and designated holidays. During the elimination period, you are required to use these balances, not to exceed 40 hours, for any regularly scheduled work hours missed due to the disability. If you do not have leave balances in your bank, you will go unpaid.

It is very important to submit your disability claim as soon as reasonably possible to avoid gaps in payroll payments. In order to be paid, your claim will have to be approved by the Memorial Hermann Leave Management Center (MHLMC). Sedgwick is the vendor who serves as our third-party administrator for these programs. If your claim is delayed or not approved, you will be required to use your leave balances, if available, or go unpaid. Your leave balances consist of paid time off (PTO), personal holidays (PHO), spiritual holiday (SHO), and designated holidays.

You can initiate your leave claim with mySedgwick online or over the phone:

Family Medical Leave (FML) may run concurrent with your disability benefit. You should contact Sedgwick at 1-855-547-3307 to file a Family Leave claim or obtain more information. Visit allHR for additional information on FML.

You will have the option to use your leave balances to cover the calculated 40% of your paycheck not covered by the STD plans. You can select this option when completing your STD claim. If you were hired before July 1, 2011, you may have Extended Illness Bank (EIB) hours. Any EIB hours will be automatically used to supplement the STD benefit.

If you elect to use your leave balances to supplement your disability benefit, please be aware that if you have any EIB hours in your bank, these hours will be automatically used before your leave balances.

Upon your return to work you will be expected to notify Sedgwick and your leader regarding your plans to return to work. In addition, you will need a signed release from your healthcare provider to return to work. Memorial Hermann requires this documentation be provided to Sedgwick at least 4 days prior to your return-to-work date. This is extremely important to do if you return to work earlier than anticipated to prevent overpayment of STD benefits.

If you cannot provide a release to Sedgwick within four days of your expected return date, you will need to send it in as soon as possible. If this documentation is not provided, your ability to return to work and your pay may be impacted.

If you return to your own occupation on a regular work schedule for 14 consecutive calendar days and then go out again for the same illness or injury, you will be required to submit a new claim and again fulfill the elimination period.

Partial disability means that you return to work to your own or any other occupation with reduced working hours due to your partial disability. If you return to work on a partial work schedule, a partial benefit may be payable if:

Memorial Hermann offers LTD coverage, managed by Lincoln Financial Group, that provides a portion of your salary if you continue to be disabled at the end of STD leave

If you work full-time, you have access to two LTD plans:

* Evidence of insurability or proof of good health may be required.

|

Details |

Basic LTD |

Supplemental LTD |

|---|---|---|

|

Eligibility |

Full-time employees |

Full-time employees |

|

Benefit |

Up to 50% of your monthly base salary |

Up to 60% of your monthly base salary (additional 10% added to Basic LTD), up to a maximum of $10,000 per month. The minimum monthly benefits is $100 or 10% of you monthly salary, whichever is greater. |

|

Pre-existing condition exclusions |

The LTD plan will not cover an injury or illness that resulted in your disability in the first 12 months after your coverage effective date, if you visited a physician, hospital or medical facility or received treatment for the condition within 90 days prior to your effective date. |

|

|

Elimination period (how long you must be out before the benefit begins) |

180 calendar days, during which you may be eligible for Short-Term Disability benefits |

|

|

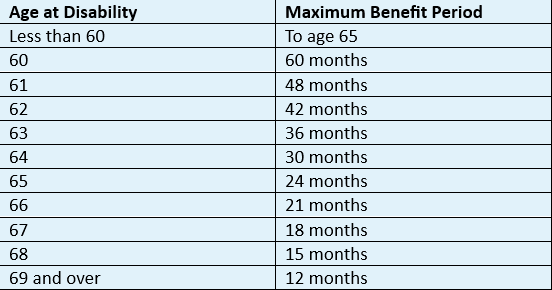

Benefit duration |

The maximum benefit period is the maximum length of time for which benefits are payable under the plan, as long as you remain continuously disabled. The duration depends on your age at disability:  |

|

|

Cost for coverage |

$0 |

Your annual salary divided by 26 = your biweekly salary. Biweekly salary x 0.00174 |

Your benefit is paid directly to you through Lincoln Financial Group.

To calculate your benefit, “salary” does not include bonuses, overtime, commissions, shift differential or special pay.

Upon notification from Lincoln Financial Group that your LTD claim is approved, your employment with Memorial Hermann may be terminated.

Certain other income benefits that you receive will reduce your monthly benefit under the LTD plans, including Social Security, SafetyNet, Salary Continuance, other employer-based insurance coverage, unemployment benefits, settlements or judgments and retirement benefits. If, for any reason, your benefit was not properly reduced by certain other income, you will be responsible for repayment.